Customer calls, texts, or submits online.

LISA asks the right questions & guides them.

Documents and photos are submitted easily by the claimant.

LISA checks for errors instantly.

Warm-hand off complex cases to an agent, fully briefed.

Call overload during disasters catastrophes.

Costly delays from manual errors

LISA checks for errors instantly.

Warm-hand off complex cases to an agent, fully briefed.

LISA handles the bulk of first notice of loss - from initial Q&A to document collection, reducing manual work dramatically from the very first interaction.

See exactly how LISA guides a customer from first contact to completed FNOL with perfect accuracy.

The next-generation workspace for today’s claims adjusters.

Yes. Floatbot.AI is pre-integrations with leading claims administration and policy management solutions, enabling seamless data flow between FNOL intake, backend systems, and claim processing platforms.

Yes. Floatbot’s AI-driven workflows are built to scale. The platform can handle high volumes of claims calls or submissions simultaneously, helping insurers maintain service continuity even during peak claim volumes or catastrophic events.

No. Floatbot.AI ensures all data, customer inputs, documents, and audit logs are captured and stored. Automation doesn’t remove human oversight — complex cases can be routed to adjusters, and audit trails remain intact to ensure compliance and control.

Yes. Floatbot.AI can automatically validate uploaded images or documents (like police reports, ID proofs, repair estimates) and flag missing or unclear information before submission.

Absolutely. platform supports multiple languages for both voice and chat, ensuring customers can file claims in their preferred language.

If a claim is missing information, the AI instantly prompts the user for clarification, requests documents, or guides them to complete the form—reducing back-and-forth communication later.

The entire FNOL flow—questions, rules, validation, routing, notifications—is 100% customizable to your product lines, state regulations, and claims processes.

Floatbot.AI can power just the FNOL intake, or extend into the full lifecycle including updates, document tracking, customer communication, and settlement support.

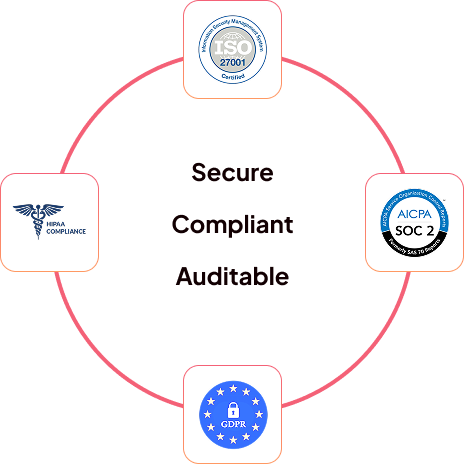

All customer data—including documents, images, and recorded interactions—are encrypted, stored securely, and processed under strict access controls to meet industry security standards.