Warm Handoff

Smart Interruption

Privately Hosted & Fine-Tuned LLMs & Speech Models (industry-specific)

50+ Analytics on Consumption, Goals, AI Usage, Success Metrics

Orchestrate Between 50+ LLMs and Speech Models

Advanced Frameworks: Agentic Flow and Agent M (MultiAgent) + Fixed Flow

Simply give a prompt – and instantly create an AI Agent, or choose from industry-ready, pre-trained AI Agents.

Add and run test cases to validate your AI Agent’s performance.

Unite customer self-service, agent productivity, workflow automation

Transform customer engagement across channels, ensuring smooth fallback from voice to text or live chat (with warm handoff)

Boost the productivity of agents with next-best action suggestions, AutoQA for SOP adherence and Call or Chat summarization (reduces ACW by 90%), along with 50+ insights to evaluate performance

Engage with customers efficiently with live chat, audio/video calling, and co-browsing for guided assistance. Features include file sharing, highlighting, masking sensitive data, and document signing

Industry-grade speech recognition with 95%+ accuracy, <50ms response time, and voice biometrics. Deployable on cloud, on-premises, or hybrid setups with fine-tuning on custom data.

An AI Workspace built for insurance teams – Adjusters, Technical Support, CSRs, and Underwriters. It automates routine admin tasks like emails, scheduling, note-taking, getting insights, report generation and document handling.

Build mid to back-office workflow automation AI Agents with human-in-the-loop. It automates data entry, email parsing, document extraction, support ticket triage; summarizing, classifying, and extracting key information from emails and documents.

Unlocks conversations that are human-like, error-free and faster

Automate workflows & business conversations with near-zero latency, driven by proprietary, privately hosted, low-latency LLM model. It works on real-time use cases with Voice AI, Chat AI, & AI Agent Assist. FloatGPT is fine-tuned on industry specific data and can be fine-tuned with your enterprise data.

Generative AI module powered by RAG that automatically learns from unstructured knowledgebase, past cases, PDF, word, graphs, documents, and website content to resolve user queries. Seamlessly integrates with third-party knowledgebase and can self-train from millions of data sources.

A powerful Master Agent framework that lets you create multiple LLM based Agents. Agent M orchestrates LLM agents that perform various tasks such as natural language-based, API calls & connects to your data, knowledgebase. It helps automate complex conversations and workflows in real time.

From API creation to AI Agent deployment, everything is intuitive

A secure connection layer that links your AI Agents to any telephony system - SIP, PSTN, Twilio, Genesys, and more – enabling real-time, reliable and fully automated voice interactions.

Floatbot UNO is a no-code/low-code platform with drag-and-drop bot studio, pre-built templates, and pre-integrated ISV/contact-center connectors — enabling you to build and deploy Voice AI Agents or Chat AI Agents within hours (not weeks), without heavy coding or infra setup.

Yes — Floatbot UNO supports both simple chat/voice bots AI Agents and complex, orchestrated multi-agent workflows (with AI orchestration, custom logic, fallback, and hybrid voice/text flows). The platform is built to scale as per your needs.

Yes — UNO platform includes 50+ interaction analytics: sentiment/intent detection, session panels, call/chat logs, performance metrics (resolution rate, compliance, disposition, etc.), helping you monitor, audit, and optimize AI Agent performance.

Floatbot UNO is cloud-agnostic and supports deployment on multi-tenant cloud, private cloud, or on-premise setups — giving enterprises flexibility to choose infrastructure based on compliance, performance, and data-privacy requirements.

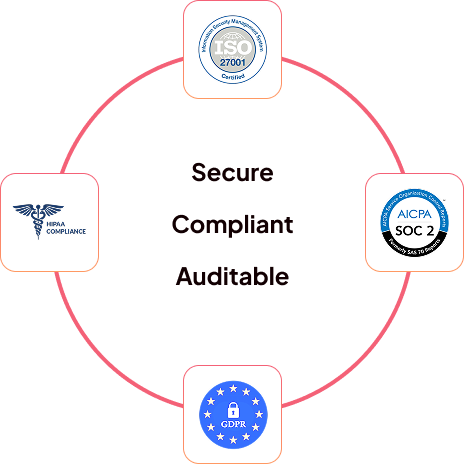

Floatbot UNO uses enterprise-grade security measures including:

These controls ensure sensitive customer conversations and operational data remain protected at every stage.

Floatbot.AI follows industry-leading security standards (SOC 2, ISO 27001, GDPR, HIPAA where applicable). All data is encrypted, access-controlled and auditable. Additionally, workflows are built to comply with insurance-specific regulations such as NAIC model laws and state-level privacy requirements.

No. AI is augmenting, not replacing, human teams. It handles repetitive, high-volume tasks so agents can focus on empathetic, judgment-driven work. Insurers are using AI to improve efficiency, customer experience and employee satisfaction – not to remove the human element.