Faster recovery + Lower Delinquencies

Recover past-due balances faster while reducing charge-offs and maintaining compliance.

Operational Efficiency + Higher CEI

Automate right-party contacts, promise-to-pay capture, and payment negotiations to maximize collector & collections output.

Portfolio ROI + Scale

Streamline outreach, increase liquidation rates, and drive profitability across purchased portfolios.

Compliance + Case Productivity

Automate compliance checks, reminders, reduce errors, and accelerate resolutions.

Throughput + Cost Efficiency

Handle high volumes with AI-driven automation, reduce cost-to-collect, and ensure consistent performance across debtors and account holders.

Debt Recovery, Customer Support, Team Enablement AI Agent

Deeper tech, built with 500K lines of code. FloatGPT, proprietary LLM delivers enterprise-grade performance with zero hallucinations.

Private by design and low latency by build. Trained on narrow models to ensure full control and regulatory compliance.

Go truly multimodal with support for voice, chat, email, SMS, images, documents, and spreadsheets.

Deploy pre-trained AI Agent built for Debt Recovery across multiple industries – healthcare, law firms, finance – fully integrated for instant value.

Scalable insights, cross-platform integrations, and outcome-focused reports.

Full AI workflow – from first contact to closure with a single vendor that scales as you grow.

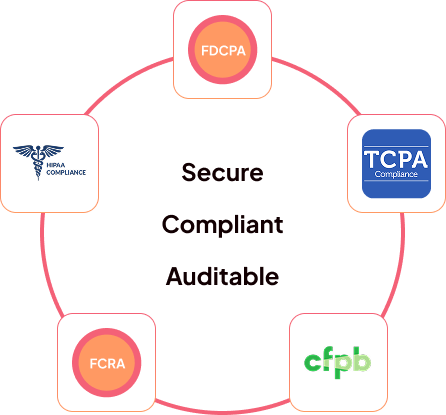

Yes, AI Agents like LEXI are designed to be fully compliant with regulations such as Reg F, FDCPA, TCPA, HIPAA, PCI-DSS and more. It includes built-in, real-time regulatory compliance filters and can reduce compliance-related errors by 40%.

LEXI automates the Right-Party-Contact (RPC) verification process with high accuracy. It proceeds with an authentication process that requests and verifies personal information like Social Security Number (SSN), Date of Birth (DOB), or zip code to confirm the correct party.

AI like LEXI is built to assist, not replace human agents. It can automate debt collections & customer support as well as function as a Copilot or Real-time Assist Collectors, CSRs and Agents.

LEXI is naturally empathetic and communicates politely, respectfully during high-emotion conversations with customers. For complex queries, disputes or escalations, LEXI will transfer the call to a live agent. The live agent receives a briefing with past conversation details for a seamless continuation.

Yes, AI like LEXI offers seamless integration with dialers, CRMs, leading payment portals, collections core applications and popular telephony & contact center platforms.

LEXI can be deployed in a matter of days or weeks, not months. It comes with pre-built templates and integrations to accelerate go-live without lengthy overhauls.

If a customer chooses not to engage with AI, LEXI politely offers to transfer the customer to a human agent immediately, ensuring they always have a choice and remain comfortable during the process.

Using AI in debt collection can provide significant ROI, including: