Cut Origination Time by 65% & Increase Conversions by 35%

Increase Team Productivity by 25%+

Reduce Delinquency Rates by 40%+

Win Back 55% of Dropped-off Loan Applicants

Recover 4x More Past-Due Accounts

Lower Service Costs by 60%

Deeper tech, built with 500K lines of code. FloatGPT, proprietary LLM delivers enterprise-grade performance with zero hallucinations.

Private by design and low latency by build. Trained on narrow models to ensure full control and regulatory compliance.

Go truly multimodal with support for voice, chat, email, SMS, images, documents, and spreadsheets.

Deploy two pre-trained AI Agents built for direct & indirect lenders and prime & subprime userbase – fully integrated for instant value.

Scalable insights, cross-platform integrations, and outcome-focused reports.

Full AI workflow – from first contact to closure with a single vendor that scales as you grow.

The AI agent sends automated reminders, updates borrowers on due dates, provides payment options, and helps them complete transactions. It ensures timely repayments, reduces delinquency rates, and eliminates manual follow-ups for agents.

Absolutely. It connects with loan management systems, CRMs, and payment platforms to provide real-time account information. This allows seamless updates, automated workflows, and personalized borrower interactions without switching applications.

AI provides 24/7 support, faster resolutions, and personalized guidance. Borrowers get instant answers about balances, payments, interest, and loan status, reducing frustration and enhancing trust in the lender.

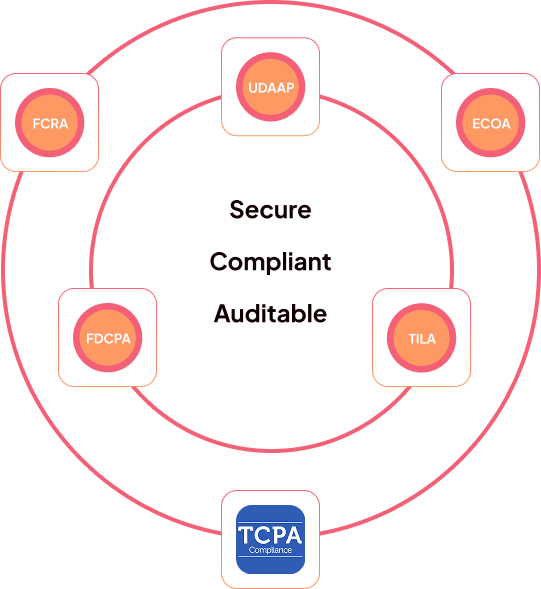

Yes. The AI Agent follows lending compliance rules, provides approved disclosures, and avoids prohibited language. It reduces regulatory risks, maintains audit trails, and ensures communications are legally accurate.

Yes. By automating repetitive servicing tasks and handling large query volumes without additional staff, the AI agent cuts operational costs and improves agent productivity, enabling teams to focus on higher-value work.

Yes. It supports voice calls, chat, SMS, email, and mobile apps. Borrowers can engage on their preferred channel, and the AI maintains context across interactions for seamless servicing.

Yes. It guides borrowers through eligibility questionnaires, document submissions, and onboarding steps. It reduces onboarding time and ensures completeness, improving conversion rates for lenders.

Definitely. The AI Agent scales across consumer loans, auto loans, mortgages, personal lending, and BNPL services. It standardizes servicing processes, reduces errors, and improves borrower engagement for all types of financial institutions.