Simplify workflows and deliver faster, more personal experiences across retail, corporate, and digital-first banking environments.

Deliver intelligent, human-like conversations across voice, chat, and messaging channels.

Automate 80% of customer engagement

Empower teams with instant insights and compliance automation.

Improve agent productivity by 25% or more

Eliminate manual gaps across the banking value chain.

Reduce email handling time by 90%

Deeper tech, built with 500K lines of code. FloatGPT, proprietary LLM delivers enterprise-grade performance with zero hallucinations.

Private by design and low latency by build. Trained in narrow models to ensure full control and regulatory compliance.

Go truly multimodal with support for voice, chat, email, SMS, images, documents, and spreadsheets.

Deploy pre-trained AI Agent built for retail & corporate banks – fully integrated for instant value.

Scalable insights, cross-platform integrations, and outcome-focused reports.

Full AI workflow – from first contact to closure with a single vendor that scales as you grow.

Yes. Floatbot.AI is pre-integrated with popular core banking systems, CRMs, and payment gateways, other systems can also be integrated using custom APIs. This enables complete end-to-end process automation.

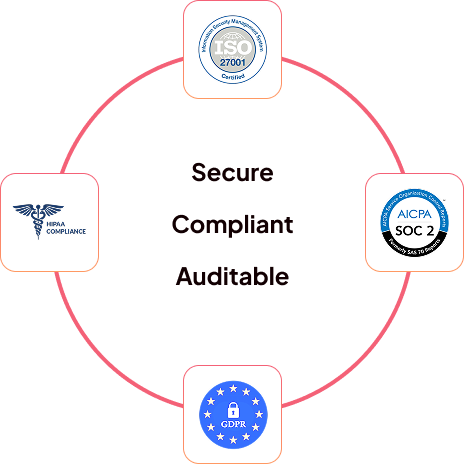

Yes. Floatbot uses strong encryption, RBAC, authentication, and PII masking. The platform follows compliance standards like GDPR, SOC 2, PCI and supports on-prem or private-cloud deployments for additional data control.

Absolutely. Floatbot supports 100+ languages, enabling banks to serve regional, national, and global audiences through both text and voice channels.

Yes. Complex or sensitive queries can be transferred seamlessly to live agents with full context, conversation history, and required customer data.

Banks can choose cloud, private cloud, on-premise, or hybrid deployments, depending on compliance, IT strategy, and data security requirements.

Most banking use cases can be deployed within 4 to 6 weeks, depending on workflow complexity, integration requirements, and compliance needs.