Manual outreach, follow-ups, and data entry eat up hours and stall recoveries.

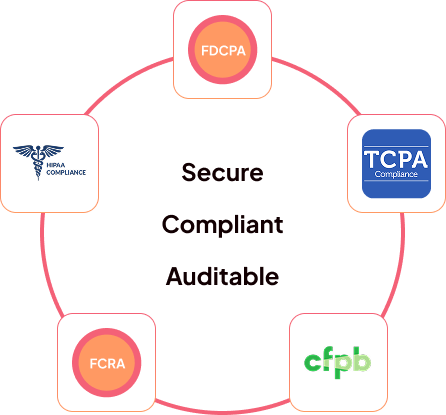

Shifting regulations are hard to keep up with, and human oversight leaves room for mistakes.

Different agents log information differently, creating gaps and errors in account history.

Proofs, validations, and attachments get scattered across tools or buried in inboxes.

With so many cases, it's hard to spot bottlenecks, track progress, or prioritize effectively.

More manual work means more staff, more oversight, and more expenses - without more recovery.

Unlocks conversations that are human-like, error-free and faster

Coordinate Multi-Agent Workflows with Intent

Deploy specialized AI Agents that collaborate across systems, manage context, and complete multi-step processes autonomously and in real-time.

Enable Real-Time, Human-Sounding Voice Conversations

Deliver speech interactions with sub-second latency, context continuity, and seamless transfer between AI and live agents.

Find Precise Answers from Any Data Source

Retrieve verified information from structured and unstructured content instantly — keeping responses accurate, compliant, and traceable.

Witness your overall financial health improve with better cash flow and reduced delinquency

Automated Reminders, Payment Negotiations, Promise-to-Pay, Right-Party-Contact

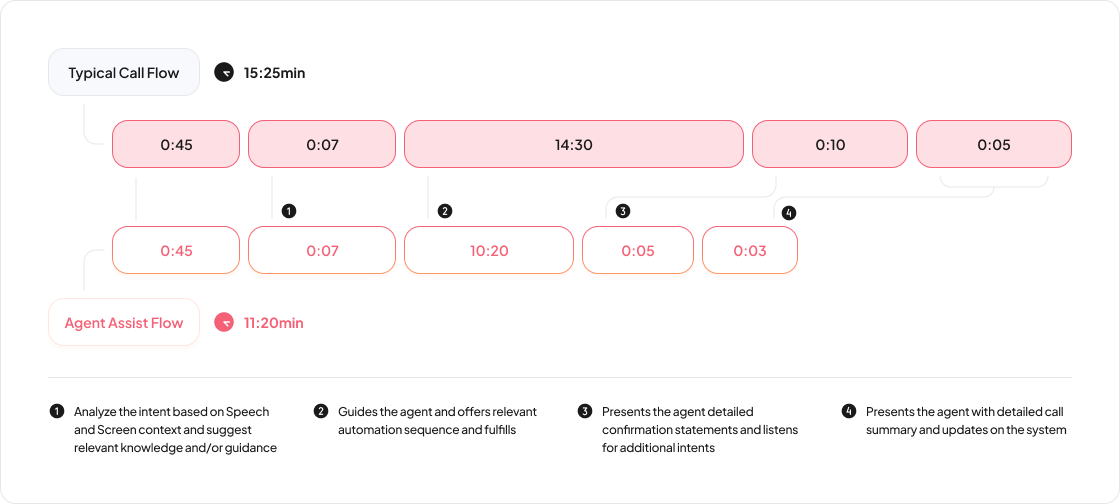

Elevates Internal Team’s Productivity, Accuracy, and Recovery Outcomes

Yes, AI Agents like LEXI are designed to be fully compliant with regulations such as Reg F, FDCPA, TCPA, HIPAA, PCI-DSS and more. It includes built-in, real-time regulatory compliance filters and can reduce compliance-related errors by 40%.

LEXI automates the Right-Party-Contact (RPC) verification process with high accuracy. It proceeds with an authentication process that requests and verifies personal information like Social Security Number (SSN), Date of Birth (DOB), or zip code to confirm the correct party.

AI like LEXI is built to assist, not replace human agents. It can automate debt collections & customer support as well as function as a Copilot or Real-time Assist Collectors, CSRs and Agents.

LEXI is naturally empathetic and communicates politely, respectfully during high-emotion conversations with customers. For complex queries, disputes or escalations, LEXI will transfer the call to a live agent. The live agent receives a briefing with past conversation details for a seamless continuation.

Yes, AI like LEXI offers seamless integration with dialers, CRMs, leading payment portals, collections core applications and popular telephony & contact center platforms.

LEXI can be deployed in a matter of days or weeks, not months. It comes with pre-built templates and integrations to accelerate go-live without lengthy overhauls.

If a customer chooses not to engage with AI, LEXI politely offers to transfer the customer to a human agent immediately, ensuring they always have a choice and remain comfortable during the process.

Using AI in debt collection can provide significant ROI, including: