If you handle catastrophe claims, you know how quickly things can spiral. One major storm or wildfire can flood your team with cases, max out your team’s capacity and frustrate customers who need fast answers. Then comes the paperwork, long waits & not to mention confusing steps. And the pressure to process everything accurately and quickly is huge. It should not be that way & it won’t be if you are leveraging AI.

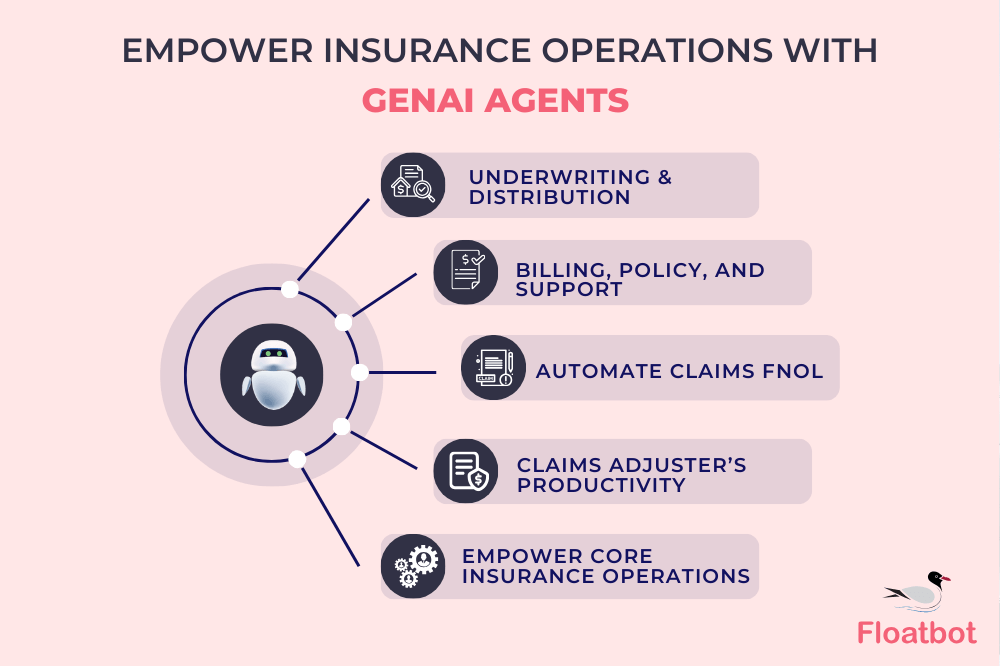

AI can help you take a lot of the busywork off your plate. AI in insurance claims can automate claims submissions. It can help adjusters by scheduling inspections, collecting evidence from customers, answering policy questions and...even writing up reports. That means you spend less time chasing down paperwork & more time actually closing claims.

AI for insurance claims can also flag missing info, suggest what to do next & handle routine calls or messages with claimants. So instead of getting stuck in the day to day details, you and your team can focus on solving problems and helping claimants faster.

Why there is a need for innovation in catastrophic claims

Catastrophic claims are the ones that come in after big disasters like hurricanes, wildfires or floods. These events can damage hundreds or maybe even thousands of homes at once. So you get a huge spike in claims, all needing attention fast.

These claims are more expensive and needless to say...more complicated than normal ones & they put a lot of pressure on your team.

If you’re still handling these claims the old fashioned way, you have probably felt the hassle. It’s easy for things to fall through the cracks. Delays happen, mistakes cost money and your team gets burned out.

That’s why there’s a growing need for better solutions that help you move faster, stay organized & take care of your customers without burning out your staff when there is a catastrophic claims spike.

Watch the video to see how insurers adopt digital solutions - yet most go unused by customers. AI Agents are changing that.

How AI can streamline Claims Operations and improve CX

Handling claims manually can slow you down, especially when you’re dealing with a high volume after a major catastrophe. Small errors turn into big delays, customers get frustrated & your team ends up spending too much time on repetitive tasks instead of focusing on resolving claims. Let us see how AI can help with insurance claims automation!

Automates claim submissions

Filing claims manually takes up a big chunk of your time as well as the claimants’. You have to gather the right details, double check everything & hope nothing gets missed. But unfortunately that's not what happens. Claim automation with the help of AI can handle up to 80% of claims filing process for you. It pulls in information from forms, checks for anything missing & fills everything out correctly.

Customers get 24/7 Support

Your customers want answer right away, especially after a big loss from catastrophe. But your team can’t be available every hour of the day. AI works round the clock, helping claimants upload documents, answer common questions & get query resolved regarding claim without waiting on hold or sending back and forth emails.

Send status updates automatically

A common complaint from claimants is not knowing what is happening with their claim. It can be tough for your team to keep track of every cases and provide updates quickly. Why the unnecessary hassle? Automatically send status updates to claimants whenever there’s progress or new step to take with AI.

And your team doesn’t have to spend hours each & every day just providing status updates.

Claims filed without errors

Mistakes in filing can slow everything down or even lead to rejected claims. AI helps make sure every claim is submitted correctly. It checks all the details, follows the correct steps & flags anything that might cause an issue. So that you can expect fewer delays, fewer re-dos and faster resolutions.

How AI boosts the productivity of catastrophe claims adjuster

With dozens or even hundreds of claims coming in at once, it’s hard to keep up as catastrophic insurance claims adjuster. AI gives catastrophe claims adjusters the extra support they need to work faster, stay organized and help more people in less time.

COPILOT

AI helps you stay on top of your work by sorting cases, sending task to the right place and keeping track of progress so nothing slips through. It pulls info from policies & your knowledge base quickly to help you make faster decisions.

AI also spots missing documents early so you don’t face delays and create detailed reports in no time. Scheduling inspection or meetings is easy because AI handles booking and updates calendars for catastrophe insurance adjuster...automatically.

AUTOPILOT

Routine communication with claimants can be taken care of by AI...such as sending updates and answering common questions, which lightens your load. It manages appointments by confirming, reminding and rescheduling as needed.

AI also collects evidence like photos, videos & documents automatically to keep everything organized. Plus, it can handle routine phone calls so you don’t have to.

COLLABORATION & COMMUNICATION

AI instantly translates text messages so you and claimants see everything in your own language and it keeps compliance in check. During calls, AI real time translates calls so you can talk with non-English speakers without needing separate translator.

For more complicated cases, audio & video calls let you connect personally to solve things faster.

REAL-TIME ASSIST

While you’re on calls, AI types out everything said and saves summaries directly to the claim file, cutting down your paperwork. It listens, takes notes and shows you relevant policy info right away so you don’t have to pause the conversation.

AI also suggests what to do next and makes sure SOPs are followed in real time.

Floatbot.AI

With Floatbot.AI, you get more than just automation. You get two powerful AI Agents designed specifically for insurance. LISA handles up to 80% of claims intake, offers 24/7 claimant support, cutting down your per-claim cost. ADDI works along side your adjusters, scheduling inspections, collecting evidence, translating in real time and generating reports. ADDI saves 40+ hours per adjuster per month.

They work together to help you achieve never-before-seen operational excellence in claims processes.

Schedule a demo to learn more.