Underwriting comes with its problems like fraud, nondisclosure and lost premiums. You probably already use data like driving history, claims, medical records and credit scores but these checks are not always complete or cheap. They only tell you if the information is accurate or not. As the need to spot risks early grows, you are going to need better solutions to manage these issues and protect your bottom line.

But good news is underwriting just got a whole lot faster and smarter. AI in insurance underwriting has reduced throughput times by 90% while improving case acceptance rates by 25%. Instead of reacting to problems after they occur, it is now about predicting and preventing them before they even surface. And Carriers can now handle more Life and P&C applications faster and offer higher coverage amounts on life policies with instant decisions.

If you start using AI, you will make smarter decisions, boost productivity, save money and give your customers a much better experience.

The ‘Black Box’ problem in traditional Underwriting

The black box nature of traditional underwriting impacts everyone involved. Applicants feel uncertain about how decisions are made, regulators demand more transparency, and insurers risk losing credibility and efficiency.

Subjectivity in decision making

Underwriting is a skill that relies heavily on human judgment, but that judgment isn’t always consistent. Personal biases, levels of experience, differing interpretations of underwriting guidelines can impact outcomes. Two underwriters reviewing the same application might arrive at completely different conclusion.

No transparency

One of the biggest challenges in traditional underwriting is the inability to clearly explain why certain decisions are made. Applicants and even regulators often face vague explanations like “risk factors” without clarity on what those factors were. Which make it harder for insurers to justify their decisions and communicate effectively with applicants or stakeholders

Inconsistent application of guidelines

Underwriting guidelines are often long, complex, and open to interpretation. While they are meant to standardize decision-making, their complexity can lead to inconsistent application. What one underwriter considers a borderline case, another might view as a clear approval or denial.

AI in underwriting addresses all of these issues in traditional underwriting.

The benefits of AI in Underwriting (How it benefits Underwriters)

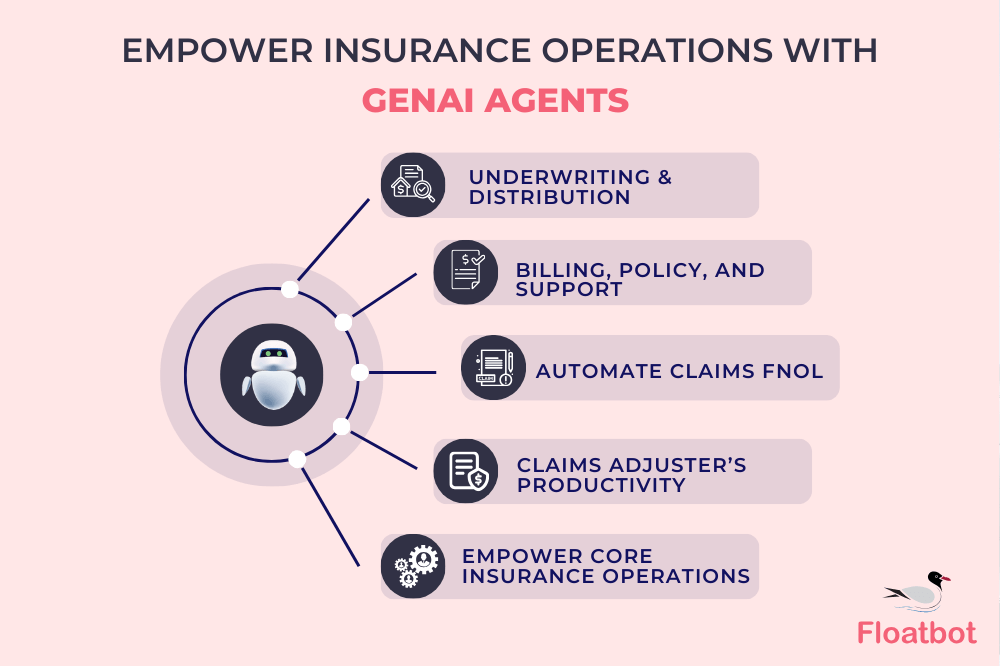

Automating Underwriting queries

AI can handle most of the questions your agents and producers have by pulling useful information from a variety of data sources. It checks policies, makes sure everything is in compliance, and keeps track of any risk factors. As a result your team has less work and can provide faster responses for everyone involved.

Pre-Trained on underwriting knowledgebases

AI in commercial underwriting comes ready to go with tons of underwriting knowledge already built in. It is trained on everything from documents and PDFs to policies and guidelines. When agents have questions, AI can answer right away, saving time, cutting down on the need for data searches or manual responses. You get quicker answers with less hassle.

Instant auto-approvals to increase speed

Instantly approve simple policy applications that meet low risk rules? Possible with AI. By doing so, underwriters can focus on complex cases. While applicants who meet the low risk criteria get approved faster. No delays on easy approvals which keeps everything moving smoothly.

95% faster document processing

AI processes documents in just minutes instead of hours. With smart features like OCR (optical character recognition) and entity mapping, it quickly pulls out important details and summarizes documents. What used to take underwriters hours to go through can now be done in seconds making whole process much more efficient.

Eliminate manual data gathering

AI in life insurance underwriting makes gathering data simple by pulling information from external third party sources and your internal systems. It automatically fills in evaluation forms, combining all the important details like structured data, unstructured text, and images into a single, unified risk profile. You get faster, more accurate data without manual effort.

Swift compliance validation

It speeds up your application-to-bind process by automating compliance checks. AI in commercial underwriting validates whether everything meets the necessary policy and regulatory standards, cutting out delays and minimizing bottlenecks. The result is a smoother, error free operation.

Automated coverage assessment

AI in life insurance underwriting quickly checks whether a particular risk matches your underwriting guidelines and suggests appropriate coverage. AI in underwriting takes care of applications faster by providing recommendations based on predefined rules and risk models, keeping everything moving efficiently.

Customized risk profiles

You can create more personalized risk profiles by considering a wider range of factors. As a result, you will make more accurate decisions by customizing the risk assessment for each individual case instead of relying on broad, one size-fits all models. Your underwriting process becomes more precise and tailored to each situation. Which is why you need AI in insurance underwriting.

Rating recommendation

It analyzes the risk factors and provides rating recommendations that suggest the right premium or coverage amount. AI in underwriting helps you offer fair and accurate pricing based on the individual risk profile which makes sure your customer always get the best deals.

Reduce human errors & human intervention

AI reduces the chances of human error by automating routine tasks and processes. It handles repetitive activities, allowing your team to focus on complex issues. With AI in charge of the routine checks, you can count on more consistent, accurate results with less human intervention.

Floatbot.AI

Keeping in mind all the issues that arises in traditional underwriting and limitations of many existing AI solution, Floatbot built AURA, the AI Agent for underwriters. Floatbot’s powerful AI Agent can serve as copilot for underwriters, enable live chat between producers & underwriters, automate agent and producer queries as well as customers and more. What you can expect with AURA:

- Reduce average days to generate each quote by 3-5 days

- 2-4% lower portfolio loss ratios

- Enhance premium volumes by 10-15%

- Increase policies evaluate per day by 30%