If you're feeling the pressure to stay competitive in the insurance landscape, there's a solution for you – Generative AI. Automate workflows, reduce your agents workloads, improve your customer retention, ensure compliance & much more.

GenAI powered insurance operations helps you to move on from outdated methods, inefficiency, higher operational costs & propels your business into a streamlined future-ready state.

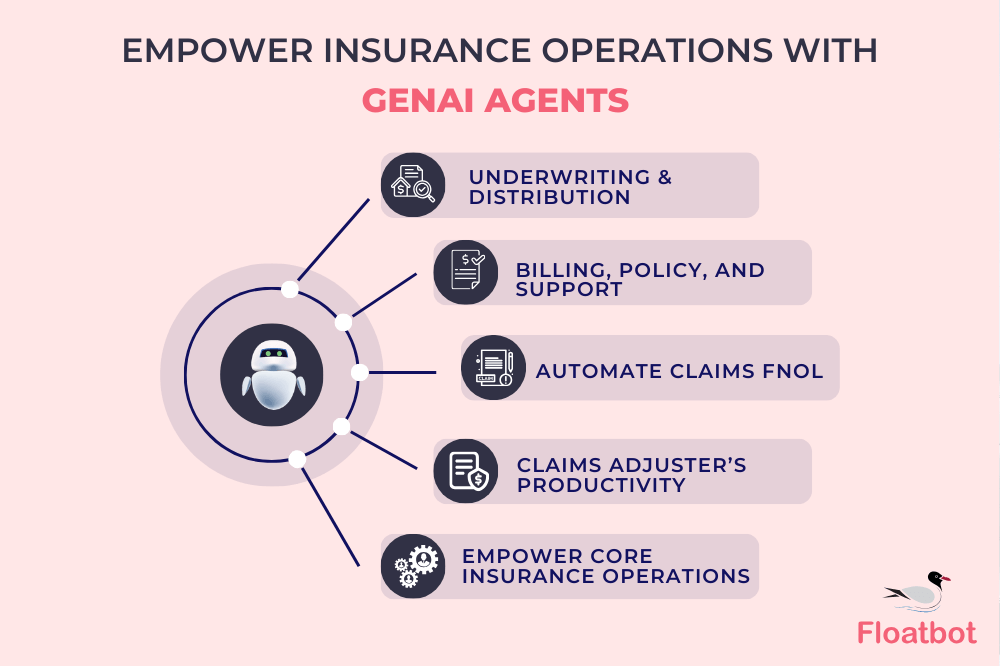

Generative AI also empowers some of the Core Operations of Insurance – Claims submissions, adjustments, underwriting, customer support, billing, policy etc. It not only helps you adapt to meet the current demands of the sector but also plays a key role in staying ahead.

HOW DOES GENERATIVE AI BENEFIT INSURANCE OPERATIONS & ITS USE CASES?

What if you could automate complex processes, reduce manual errors & provide exceptional service & support and ensure compliance all at once? With Generative AI all of this is possible.

Probably why the global market for generative AI in insurance is projected to expand from USD 346.3 million in 2022 to USD 5.54 billion by 2032, reflecting a compound annual growth rate (CAGR) of 32.9% from 2023 to 2032.

Watch, for example, how Floatbot's AI Agent LISA automates Claims FNOL filing.

Let us see where exactly generative AI fits in with insurance operations & how it benefits the sector.

Streamline Underwriting & Distribution

Underwriting is a critical part of your insurance process. But it often involves a lengthy application-to-bind timeline (the lifecycle when a customer submits an application to the point it actually becomes effective).

Generative AI in insurance underwriting can speed up your process from application to binding a policy, you ensure that your customers get covered faster and more efficiently, enhancing their experience and satisfaction.

Automate Underwriting Queries

It can handle the bulk of underwriting queries on your behalf, reducing the workload on your agents and producers. So while GenAI takes charge of the routine tasks, your underwriters can focus on complex and critical tasks.

Enable Instant Auto-Approval

Let Generative AI automatically approve low-risk applications & streamline your approval process and reduce wait times. What happens is, when certain applications meet a pre-defined criteria, GenAI will deem it fit to be approved since it is low risk.

Assist with Risk Evaluation, Coverage Decisions, Setting Premiums and More

Generative AI can help in setting appropriate premiums, evaluating creditworthiness, evaluating risk and determining loan terms. You can automate these financial assessments, and ensures that all decisions are well-grounded improving the overall financial health of your business.

Optimize Billing, Policy, and Support

Managing billing processes, policy administration, and customer support are essential for maintaining operational efficiency, customer satisfaction & your financial health.

Generative AI is meant to streamline these critical aspects of your insurance operations.

Manage Billing Processes

Generative AI automates and manages your entire billing process, ensuring accuracy and timeliness. It handles the entire billing cycle, from generating invoices to sending them to policyholders.

It can also send automated payment reminders to your customers about upcoming due dates, significantly reducing missed payments. And identifies and flags payment discrepancies initiating prompt communication with customers to resolve issues.

Policy Administration

Generative oversees policy issuance by verifying necessary information, ensuring compliance with regulatory requirements and generating policy documents automatically. For policy renewals, it tracks expiration dates and sends automated reminders to customers, processing renewals by updating policy details and issuing new policy documents.

When customers need to make changes to their policies, such as adding coverage or updating personal information, Generative AI swiftly and accurately handles these amendments. It also ensures compliance management by maintaining adherence to industry regulations and company policies.

Customer Support

Generative AI revolutionizes customer support by providing 24/7 availability, ensuring that your customers can get assistance whenever they need it. It handles a wide range of customer inquiries instantly, from basic questions about coverage to complex issues involving claims and policy details.

With omnichannel support, Generative AI interacts with customers across various platforms, including phone, email, chat & text ensuring a seamless and consistent experience.

It also enhances issue resolution by efficiently triaging and prioritizing cases, escalating them to human agents, when necessary (fallback feature), and ensuring customers receive the right level of support promptly.

Accelerate & Automate Claims FNOL (First Notice of Loss)

The claims processing is overwhelming and time-consuming. Generative AI in insurance claims can help you handle it efficiently and accurately. Handle initial claim reporting by automating the FNOL intake, capturing all necessary details accurately and reducing manual errors. This can be done on call or text.

Send immediate acknowledgment and updates to policyholders upon claim submission. Kickstart the claims process, enhancing the overall customer experience with swift and efficient handling.

Enhance Claims Adjuster’s Impact & Productivity

When the pressure's on, adjusters feel it first. After a natural disaster or during peak seasons, claims don’t just trickle in, they pour. With limited hours in day and rising expectations, adjusters are often juggling case after case with no margin for error.

Generative AI, as your copilot, keeps things organized. Whether it’s pulling up policy details or flagging missing information, it helps you stay on top of the details so nothing slips through the cracks. When running on autopilot, it takes over the repetitive tasks that eat up your time. Scheduling appointments, gathering documents, and handling routine communication with claimants all get streamlined in the background.

It also acts as a communication bridge. With built-in live translation and two-way texting, Generative AI makes it easier to connect with claimants, regardless of language barriers or communication preferences. In real time, GenAI steps in as a assistant. It transcribes calls, takes notes automatically and even recommends the next best steps.....freeing up adjusters to focus on the human side of the job. The result is a more efficient workflow, faster claims resolution, fewer errors and more time to concentrate on the work that truly needs your expertise.

Empowering Core Insurance Operations with Human in the Loop

Generative AI is often seen as a replacement for human expertise. But in reality, its true potential lies in empowering humans. Sure it can automate the workflows and work autonomously. But if the need for human expertise is present Generative AI for insurance agents can handle that too by working alongside them.

In fact, combining Generative AI with human expertise ensures a balanced approach to your operations. Furthermore, leveraging the strengths of both AI and human insight optimizes your service delivery.

FLOATBOT.AI

Floatbot’s GenAI-powered AI Agents – LISA, ADDI, AURA and LEXI were built for the core uses cases and operations of insurance sector - Claims FNOL, Underwriting, Adjustment, Support, Billing, Policy, Catastrophic Insurance Claims, and Distribution. To ensure the best and most efficient workflows, Floatbot is also pre-integrated with leading CCaaS and insurance solutions such as Genesys, NICE CXOne, Five9, Socotra, Guidewire, INSTANDA, etc. Empower your core operations, boost your revenue, and free up your human agents and reps to focus on what they do best.