Whether you are looking at the broader scope of insurance automation or diving into specific areas like generative AI in insurance, one thing is clear. Automation is set to transform the insurance sector. AI in insurance is taking over task that once required manual effort. For you this means more time to focus on what really matters, delivering exceptional service and driving growth.

More importantly making insurance processes faster, more accurate & ultimately more profitable

Let us explore that today.

Role of Automation in Insurance

By simplifying both the front and back end operations, intelligent automation allows you to scale your insurance services without having to hire a lot more staff and that means more savings for your business. Especially on the back end, automation speeds up traditionally slow processes like claims processing and policy management, cutting down on customer wait times.

And what do you get? You create smoother experience for your customers, which can boost their satisfaction and encourage long term loyalty to your services. These are some benefits of automation in insurance

- Streamline the process for humans and provides high quality for the customers virtually

- Helps in data driven Underwriting and retrieving accurate data digitally

- Evaluation of risks and the Coverage for each customer

- Reduce cost and increase Efficiency while boosting the outcomes

- Optimize the process adding value to the tasks

- 24/7 Round the Clock support for its customers

- Accelerates the buying journey for customers

- Schedule calls and meetings, retrieve/generate documents, updating information in the customer’s profiles and tasks alike.

AI Powered Automation in Claims, Policy, Service

Claims, policy and service are the three core areas in insurance. By integrating AI Automation into these critical areas, insurers are doubling (maybe more) their efficiency. It is no wonder the compound annual growth rate (CAGR) for AI in insurance is expected to rise 33.06% from 2023 to 2032 reflecting the massive potential and growing adoption of insurance automation.

We can now see how AI automation plays key role in all the above mentioned areas in insurance.

Automate Claims Submissions

One of the most significant areas where you can benefit from AI automation is claims management. By automating the First Notice of Loss (FNOL) processes, you can dramatically reduce the time it takes to initiate and process claims.

Gen AI in insurance ensures that claims are handled swiftly and accurately, minimizing errors and providing quick updates to your claimants. You could see your operational cost drop. Since you’ll be handling less manual work and speeding up your processes

On top of that ai in insurance can sift through loads of data to spot and stop fraud, helping to protect your business from risks.

Automate Claims Support

One of the biggest advantages of automating claims support is it allows you to provide assistance 24/7/365. Customers can reach out at any time with questions or concerns about their claims.

Your customers want answers, and they want them now. Automating claims support will enable your customers to effortlessly check the status of their claims in real time, offering them peace of mind & reducing the burden on your support staff.

By automating claims support you significantly reduce operational costs that comes with staffing and manual processes.

Empower Claims Adjusters & Increase their Efficiency

Insurance automation simplifies the workflow for adjusters by streamlining key tasks. Effortlessly schedule inspections or meetings with claimants.

For instance, with Floatbot’s ADDI (Digital Worker for Claims Adjusters), all you have to do is just ask. “Hey ADDI, can you schedule my visit with this Claimant on next Wednesday between 2 to 5 PM”?

ADDI will reach out to claimant on call, text and get the meeting scheduled and will place it on both party's calendar”

When additional Evidence is needed, ai in insurance can handle that. Simply request the needed information, and the system will contact claimant, convey request and send reminders till evidence is collected. Once received it will automatically attach the evidence to the claim.

Ai in insurance also helps quickly retrieve necessary information ensuring adjusters have everything they need at fingertips. And generate reports that meet industry standards, streamlining documentation.

Generative AI in insurance also comes in handy with real time translation features. Both languages are displayed in the chat interface, ensuring that everyone stays on the same page.

Transforming Underwriting & Distribution

Insurance automation is transforming the underwriting process by handling underwriting queries for agents & producers. By eliminating manual data gathering and streamlining sales queries, automation enhances premium volumes.

With access to extensive knowledgebases, PDFs and documents, ai in insurance empower underwriters & producers to focus on what matters most. making informed decisions and driving growth.

For distribution agents, automation in insurance provides instant policy recommendations based on customer preferences & risk profiles. It assists in comparing products, supports the sales process with up to date information, & facilitates cross selling & upselling opportunities

Additionally, insurance automation extends digital sales across multiple channels, enabling distributors to generate insurance quotes quickly and accurately.

Streamlining Billing, Policy, Support

Automation in insurance is transforming way billing processes are managed, making them more efficient and user friendly. By automating essential tasks such as invoicing & payment reminders, businesses can reduce manual errors and ensure timely payments, enhancing cash flow. Additionally AI in insurance provides 24/7 support to policyholders, allowing them to receive assistance whenever they need it.

Moreover, automation in insurance efficiently handles policy inquiries, updates, and issuance, streamlining communication & reducing response times. Compliance with regulatory requirements is another critical aspect that AI manages seamlessly ensuring that all billing-related processes adhere to the latest standards.

Floatbot.AI

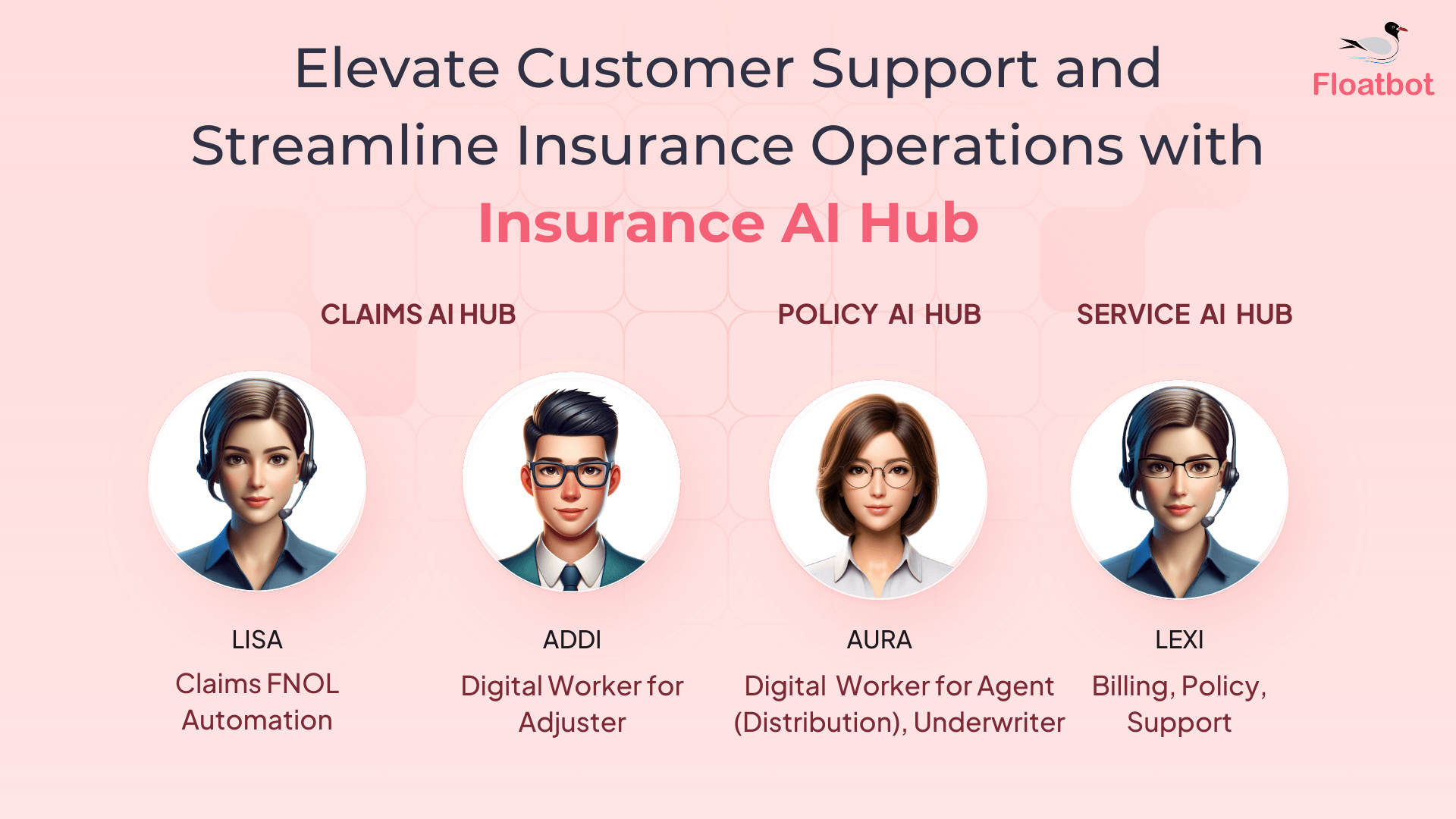

Get ready to transform your insurance operations with Floatbot.AI! Our all-in-one Insurance AI Hub: Claims AI Hub (LISA + ADDI), Policy AI Hub (AURA) and Service AI Hub (LEXI) harnesses the power of advanced LLM-driven AI agents. Our integrated platform is designed to simplify your processes, enhance agents productivity especially for catastrophe claims adjusters, and elevate your business to new levels of success. What you can expect:

- Automate up to 80% of claims FNOL (LISA)

- Save 40+ hours per adjuster, per month (ADDI)

- Increase RFP/policy Turnaround by 2x (AURA)

- Automate 60% of support calls (LEXI)

Schedule a demo. See Insurance AI Hub in action.